Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

UK Price Rises Persist, FTSE Fluctuates, Sterling Nears Peak

TOPICSTags: British Pound Sterling, FTSE100, Inflation, UK

The FTSE 100 closed 0.28% higher on Wednesday, driven by gains across multiple sectors. Oil majors, miners, utilities, and defensive stocks such as pharmaceutical companies and tobacco firms all contributed to the index’s positive performance.

Burberry emerged as the standout performer, leading the index with a rise of over 4%. This surge was attributed to speculation surrounding recent insider buying activity, including another small director purchase reported on the day.

In the energy sector, oil giants BP and Shell saw notable gains of 1.4% and 0.8% respectively. These increases were primarily fueled by rising oil prices in the global market.

(FTSE 100 Index Monthly Chart)

The Consumer Prices Index (CPI) in the UK held steady at 2% in June, aligning with the Bank of England’s (BOE) target for the second consecutive month. However, this headline figure masked underlying concerns, particularly in the services sector where inflation remained stubbornly high at 5.7%.

These results diverged from economists’ expectations. The consensus forecast had anticipated a slight decrease in the headline rate to 1.9%. Moreover, the BOE had projected services inflation to be at 5.1%, significantly lower than the actual figure.

The persistence of inflationary pressures in the services sector suggests that while overall inflation is currently at the target, it may not remain there for long. This development could potentially delay the BOE’s plans to cut interest rates.

In response to these figures, financial markets adjusted their expectations. Traders reduced the probability of a rate cut on August 1st to approximately 30%, down from over 40% the day before. This shift in sentiment was reflected in the currency markets, with the British pound strengthening to $1.3, maintaining levels close to its one-year highs.

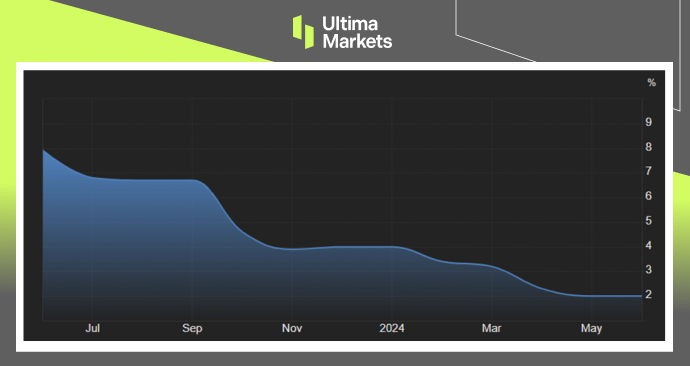

(UK Inflation Rate YoY%, Office for National Statistics)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Neden Ultima Markets ile Metaller ve Emtia Ticareti Yapmalısınız?

Ultima Markets, dünya çapında yaygın emtialar için en rekabetçi maliyet ve değişim ortamını sağlar.

Ticarete BaşlaHareket halindeyken piyasayı izleme imkanı

Piyasalar arz ve talepteki değişimlere duyarlıdır

Sadece fiyat spekülasyonu ile ilgilenen yatırımcılar için çekici

Derin ve çeşitli likidite ile gizli ücretler yok

Dealing desk yok ve yeniden fiyatlandırma yok

Equinix NY4 sunucusu üzerinden hızlı yürütme