Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Unemployment Falls to 4%, Fed Eyes Inflation Outlook

TOPICSTags: FED, Hourly Earnings, Labor Market, NFP, Unemployment

U.S. Job Growth Slows, Inflation Risks Persist

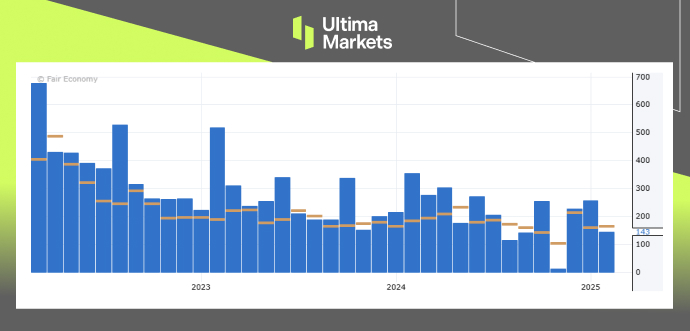

New data from the U.S. Bureau of Labor Statistics, released on Friday, revealed that average hourly earnings have remained above 4% year-over-year since last fall, a level exceeding the Federal Reserve’s comfort zone for maintaining its 2% inflation target. Additionally, a survey showed a sharp increase in consumer inflation expectations for the year ahead, rising to 4.3% in February from 3.3% in January. Moreover, the latest data revealed that companies added 143,000 jobs in January, falling slightly short of the 170,000 forecasted. However, upward revisions to previous figures further strengthened the already robust job gains recorded at the end of 2024.

(U.S Non-Farm Employment Change, Source: Forex Factory)

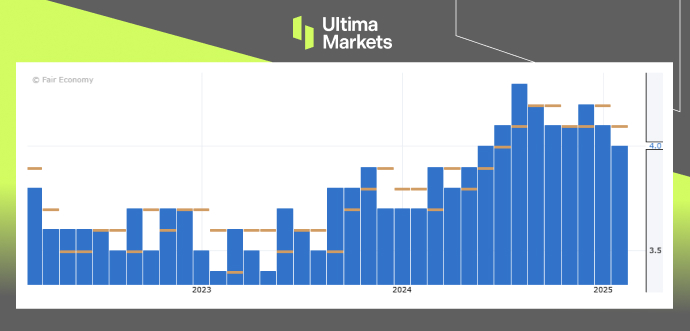

Despite concerns about labor market weakness last year, when the unemployment rate edged higher, the job market has since rebounded, with unemployment falling to 4% last month. Speaking at an auto symposium in Detroit on Thursday, Chicago Fed President Austan Goolsbee reflected on the shift, noting that the central question had been whether the economy would stabilize at full employment or face a sharp rise in joblessness, as historically seen when unemployment trends upward.

Instead, the labor market appears to have settled at full employment, Goolsbee suggested, emphasizing that while conditions could still overheat or deteriorate, the current balance is ideal from a policy standpoint. Although unemployment remains slightly higher than the 3.4% low of 2023, it is still below the 4.2% threshold the Fed associates with stable inflation, reinforcing the view that the central bank has avoided a recession while creating enough slack to curb inflationary pressures.

(U.S Unemployment Rate, Source: Forex Factory)

However, the risk now lies in whether inflation will continue its downward trajectory. Revised data indicate that wage growth has remained at or above 4% year-over-year, a persistent challenge for the Fed. Meanwhile, the recent uptick in inflation expectations highlights policymakers’ concerns about maintaining public confidence in their ability to bring inflation under control.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행