Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Trump Address Stock Market, Tariff’s Uncertainty Go On

TOPICSTags: CPI, Trade War, Trump, Trump Tariff, US Stock Market, USDCAD

US President Donald Trump addressed the stock market once again at a White House event on Tuesday, as U.S. equities remained under selling pressure in recent weeks due to growing uncertainty surrounding Trump’s tariff policies.

Trump: “We had to go and do this”

On March 11, 2025, President Donald Trump addressed the recent downturn in the U.S. stock market, emphasizing the need to endure short-term economic challenges to “rebuild our country.”

Acknowledging market volatility, he stated, “Markets are going to go up, and they’re going to go down.” Despite significant declines in major indices like the S&P 500 and Nasdaq Composite, Trump defended his tariff policies, arguing that short-term fluctuations were part of a broader economic transition.

In a meeting with CEOs from major U.S. companies on Monday, Trump reiterated that tariffs would financially benefit the country, even as investors raised concerns about potential inflation and economic slowdown.

Tariff Uncertainty: Trump’s Reversal on Canada’s Steel Tariffs

Meanwhile, Trump announced plans to double tariffs on Canadian steel and aluminium imports to 50%, up from the existing 25%. The heightened tariffs were aimed at pressuring Canada to revise its trade policies.

However, within hours, Trump retracted the 50% tariff threat after Canada agreed to suspend the electricity surcharge on U.S. and scheduled a meeting with U.S. officials in Washington.

Although the immediate escalation was averted, investors remain cautious as Trump’s tariff policies continue to introduce uncertainty into market dynamics.

(USDCAD, 1-H Chart; Source: TradingView)

The U.S. dollar surged against the Canadian dollar following the announcement of 50% tariffs. However, the gains were quickly reversed after Trump withdrew the tariff threat, with USDCAD largely trading below the 1.4500 mark.

US Market Holds as CPI Data Awaited

Despite ongoing uncertainty and market fears, both the U.S. dollar and U.S. equities remained stable in Tuesday’s session as investors await the latest U.S. inflation data.

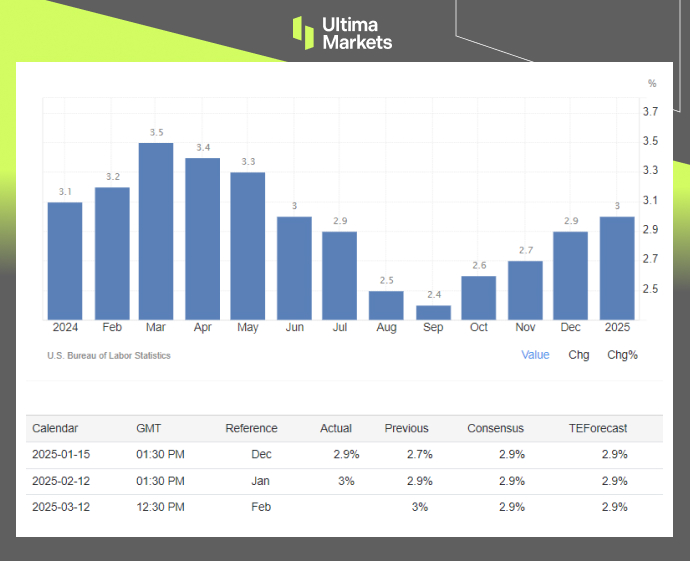

(US Consumer Price Index; Source: Trading Economics)

The February headline inflation rate is expected to tick down slightly to 2.9% from 3.0% in January. However, it remains elevated above the Federal Reserve’s 2% target, keeping market participants on edge regarding future monetary policy decisions.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행