Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

ADP Employment Falls to 7-Month Low, US Dollar Tanks

TOPICSTags: DXY, economic data, Trump, Trumpcession, US dollar, VIX

ADP Employment Falls to 7-Month Low, US Dollar Tanks

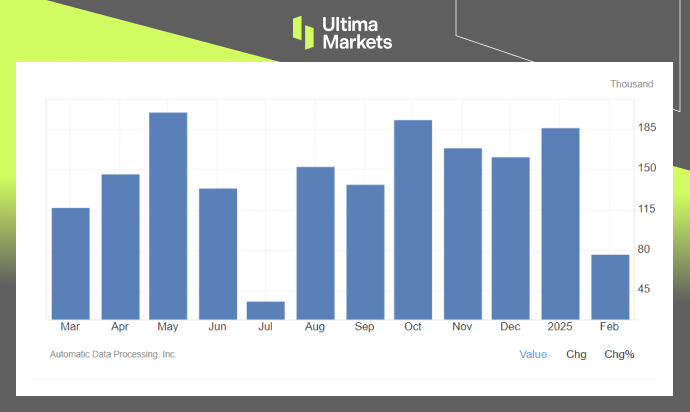

The ADP Employment Change report released yesterday showed that private payrolls added just 77K jobs in February, marking the smallest increase in seven months. This was a sharp decline from an upwardly revised 186K in January and fell well below the forecast of 140K.

(US ADP Employment Change; Source: Trading Economics)

With this weaker-than-expected data, market attention now shifts to the February US Non-Farm Payrolls (NFP) report on Friday. Most economists predict an increase of 160K, slightly above the previous month. However, given ADP’s weak performance, the actual NFP figure could come in lower than anticipated.

“Trumpcession” Weighing on the US Economy?

Investor concerns are growing over President Trump’s recently announced aggressive trade stance, which could lead to stagflation—a period of stagnant economic growth alongside rising inflation. This uncertainty further complicates the Federal Reserve’s policy outlook, adding pressure to the US economy and also the US Dollar.

The US equity markets have also felt the strains, with the S&P 500 Index erasing its post-election gains and the Nasdaq Composite nearing it correction territory. Technology stocks, in particular, have suffered amid fears that higher input costs and potential retaliatory tariffs could weigh on profitability.

Meanwhile, the CBOE Volatility Index (VIX), often called Wall Street’s “fear gauge,” pulled back yesterday but remains above 22, reaching a multi-month high as traders brace for further market turbulence.

(S&P 500 Volatility Index (VIX); Source: Trading View)

Outlook for US Dollar Index

This has put significant pressure on the US dollar, leading to its sharpest three-day decline since November 2022. The US Dollar Index (DXY) has dropped 2.5% over this period, falling below 104.50. The dollar’s weakness may continue to weigh on sentiment, with further downside potential in the 104.50 to 103.40 range.

(US Dollar Index, Day Chart Analysis; Source: Trading View)

While a rebound in the US dollar is possible, the overall outlook remains bearish given the current market sentiment. Any recovery may be temporary, serving as a short-term relief until a significant shift in market dynamics occurs.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행