Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Mann Signals Caution Despite Bold Rate Cut Move

TOPICSTags: BoE, Mann, Rate Cut, UK Economy, UK Inflation

BoE’s Mann Clarifies Surprise Rate Cut Vote

Bank of England policymaker Catherine Mann clarified on Tuesday that her unexpected vote last week for a 50 basis-point rate cut should not be interpreted as support for a series of reductions or an indication that she would take the same stance in March. While her decision surprised investors, it aligned with her generally proactive approach, in contrast to the more measured, step-by-step strategy preferred by most members of the BoE’s Monetary Policy Committee.

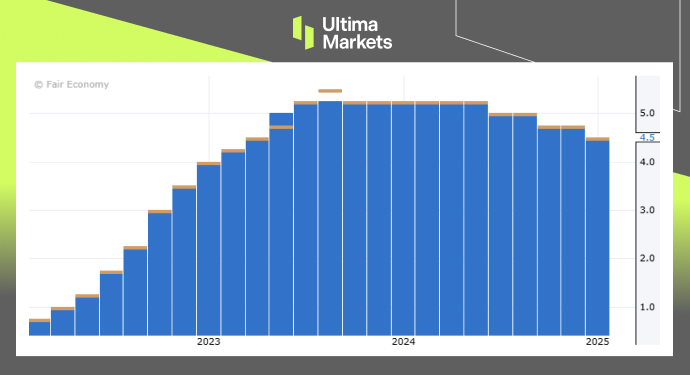

(Bank of England’s Bank Rate, Source: Forex Factory)

Speaking on Tuesday, Mann reaffirmed her belief in maintaining restrictive monetary policy and estimated that the long-term neutral interest rate for the UK would likely be at the upper end of the 3.0-3.5% range identified in a BoE investor survey. Her outlook differs from that of Swati Dhingra, another Monetary Policy Committee member who also supported a 50 basis-point cut who has consistently advocated for looser monetary policy.

Mann explained that, until now, she had favored keeping rates unchanged due to structural weaknesses in the UK economy that contribute to inflationary pressures. She pushed back against the idea that her vote signaled support for back-to-back cuts, stating: “Those structural impediments continue to be in evidence in this economy, and so the notion that somehow I support ’50 now, 50 next time’, that would not be a full reading of what I have just said.”

However, she ultimately shifted her stance after seeing enough signs of weakening consumer demand, a potential sharp downturn in the labor market, and declining corporate pricing power, leading her to drop her opposition to cutting rates.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행