Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

澳大利亚联储保持利率不变,澳币回弹

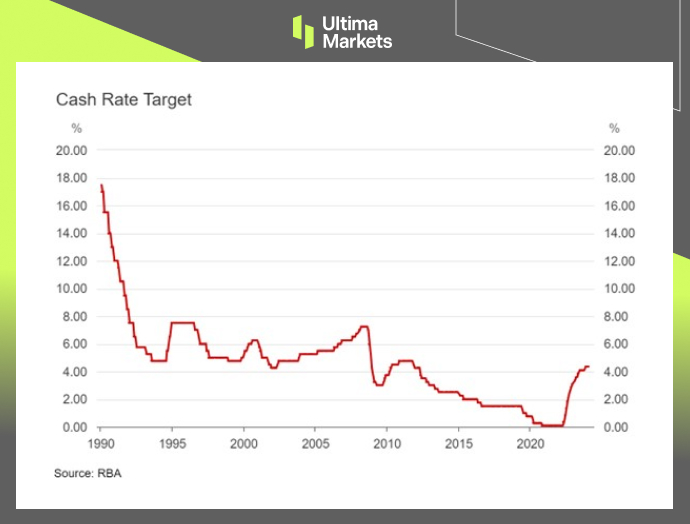

去年除1月外,澳大利亚央行(RBA)召开11次利率会议。 自今年起,会议缩减至8次。 于2024年首次货币政策会议上,考量通膨压力降温,澳大利亚央行维持官方现金利率在4.35%不变,符合市场广泛预期。

过去两年该央行已累计升息425个基点,以遏制新冠疫情大流行后引发的通货膨胀。 尽管观察到越来越多的证据显示成本和供给端压力有所缓解,但澳大利亚央行注意到服务业通胀居高不下,埋下不确定因子,综合整体价格水准仍高于目标。

如果未来公布的经济数据需要,进一步的政策紧缩仍然是选项,澳大利亚央行官员强调,利率走向确切轨迹将取决于不断变化的通胀和就业前景以及对经济扩张持久性的最新风险评估。 另外明确说明,通胀必须令人信服地在2025年回到2-3%的目标区间,然后在2026年期中稳固,以作为最终利率政策正常化的先决条件。

澳大利亚央行委员会在声明总结时承诺,将始终保持警惕,追踪全球经济、国内需求、劳动力市场,特别是通胀的趋势,为中期货币政策的适当转向提供资讯。 在澳大利亚央行利率决议后,澳元兑美元上涨至0.65左右,自11周以来的最低点弹升。 然而,因为乐观的美国经济数据和美联储的鹰派言论降低了美国未来降息的期待,澳元的涨幅受到美元走强的箝制。

(澳大利亚联储三十年利率变化)

(AUDUSD周线图)

随时随地观察市场动态

市场易受供求关系变化的影响

对关注价格波动的投资者极具吸引力

流动性兼顾深度与多元化,无隐藏费用

无对赌模式,不重新报价

通过 Equinix NY4 服务器实现指令快速执行